Your Discounted cash flow calculator online images are ready in this website. Discounted cash flow calculator online are a topic that is being searched for and liked by netizens today. You can Find and Download the Discounted cash flow calculator online files here. Get all free vectors.

If you’re looking for discounted cash flow calculator online pictures information linked to the discounted cash flow calculator online topic, you have visit the right site. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

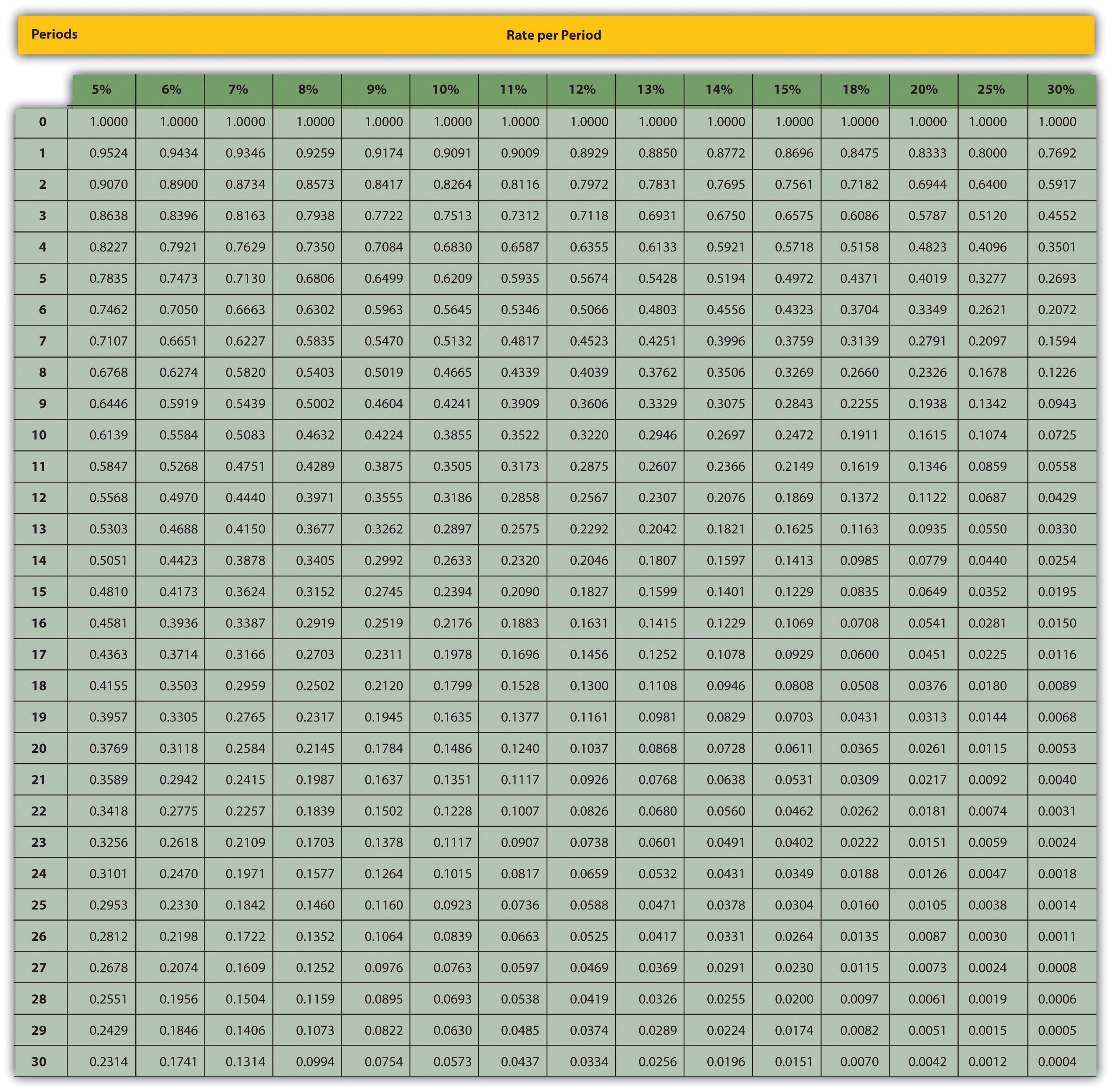

Discounted Cash Flow Calculator Online. Fcf formula = net cash from/(used in) operating activities minus purchase of fixed assets You want to know the present value of that cash flow if your alternative expected rate of return is 3.48% per year. The method helps to evaluate the attractiveness of an investment opportunity based on its projected future cash flows. Our online discounted cash flow calculator helps you calculate the discounted present value (a.k.a.

Texas Instruments BA II Plus Financial Calculator in 2020 From in.pinterest.com

Texas Instruments BA II Plus Financial Calculator in 2020 From in.pinterest.com

Using the discounted cash flow calculator. Our online discounted cash flow calculator helps you calculate the discounted present value (a.k.a. We can conclude from this that the dcf is the calculation of the pv factor and the actual. Quit worrying as you can calculate the results from fixed or irregular cash flow each year by using this calculator. The discounted cash flow stock valuation calculator is relatively straightforward but allows customization with advanced options. It’s a streamlined spreadsheet model that keeps things fast and simple, and can be used on a variety of platforms.

Basically, a discounted cash flow is the amount of future cash flow, minus the projected opportunity cost.

The other cash flows will need to be discounted by the number of years associated with each cash flow. You want to know the present value of that cash flow if your alternative expected rate of return is 3.48% per year. And also provides a downloadable wacc calculator) raised to the power of the period number. Plugging the above cash flows into the irr calculator will reveal that my offer would yield a 2.99% average annual rate of return. Discounted cash flow is more appropriate when future condition are variable and there are distinct periods of rapid. It assumes that the value of a business is equal to the total cash flows accrued over a period of time.

Source: pinterest.com

Source: pinterest.com

The analysis can be a handy tool to an investor when used right. Under this method, the expected future cash flows are projected up to the life of the business or asset in question, and the said cash flows are discounted by a. Starting in year 3 you will receive 5 yearly payments on january 1 for $10,000. Take 3 years’ average free cash flow (fcf) as this starting number. So, the two parts of the calculation (the cash flow and pv factor) are shown above.

Source: pinterest.com

Source: pinterest.com

So, the two parts of the calculation (the cash flow and pv factor) are shown above. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. The other cash flows will need to be discounted by the number of years associated with each cash flow. Fcf can be calculated from the cash flow statement. What makes discounted cash flow (dcf) model more accurate?

Source: pinterest.com

Source: pinterest.com

In fact, discounted cash flow method considers the startup value to be equal to the present value of the cash flows that it will generate in the coming years. Discounted cash flow calculator business valuation (bv) is typically based on one of three methods: Plugging the above cash flows into the irr calculator will reveal that my offer would yield a 2.99% average annual rate of return. Discounted cash flow is more appropriate when future condition are variable and there are distinct periods of rapid. Discounted cash flow valuation or dcf valuation is one of the main methods used to estimate the value of a business.

Source: in.pinterest.com

Source: in.pinterest.com

The income approach, the asset approach and the market (comparable sales) approach. This is also known as the present value (pv) of a future cash flow. And also provides a downloadable wacc calculator) raised to the power of the period number. By default, it uses earnings per share to run valuations; Quit worrying as you can calculate the results from fixed or irregular cash flow each year by using this calculator.

Source: pinterest.com

Source: pinterest.com

Plugging the above cash flows into the irr calculator will reveal that my offer would yield a 2.99% average annual rate of return. Here is the dcf formula: Under this method, the expected future cash flows are projected up to the life of the business or asset in question, and the said cash flows are discounted by a. Fcf formula = net cash from/(used in) operating activities minus purchase of fixed assets Discounted cash flow is more appropriate when future condition are variable and there are distinct periods of rapid growth and then slow and steady terminal growth.

Source: pinterest.com

Source: pinterest.com

The income approach, the asset approach and the market (comparable sales) approach. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. So, the two parts of the calculation (the cash flow and pv factor) are shown above. Intrinsic value) of future cash flows for a business, stock investment, house purchase, etc. Also, this discounted payback period calculator estimates the cumulative cash flow discounted cash flow and cash flow of each year.

Source: pinterest.com

Source: pinterest.com

You can find company earnings via the box below. The discounted cash flow stock valuation calculator is relatively straightforward but allows customization with advanced options. Discounted cash flow calculator business valuation (bv) is typically based on one of three methods: The method helps to evaluate the attractiveness of an investment opportunity based on its projected future cash flows. N = the period number.

Source: pinterest.com

Source: pinterest.com

This is also known as the present value (pv) of a future cash flow. Npv calculator to calculate discounted cash flows. Before that, let’s discuss the process of dcf analysis. The method helps to evaluate the attractiveness of an investment opportunity based on its projected future cash flows. Using the discounted cash flow calculator.

Source: pinterest.com

Source: pinterest.com

Starting in year 3 you will receive 5 yearly payments on january 1 for $10,000. The discounted cash flow (dcf). You want to know the present value of that cash flow if your alternative expected rate of return is 3.48% per year. How to calculate discounted cash flow (dcf) formula & definition. Intrinsic value) of future cash flows for a business, stock investment, house purchase, etc.

Source: pinterest.com

Source: pinterest.com

The income approach, the cost approach or the market (comparable sales) approach. We will see more about these later. Expanding the advanced options tab allows you to use free cash flow instead. Before that, let’s discuss the process of dcf analysis. Among the income approaches is the discounted cash flow methodology that calculates the net present value (npv) of future cash flows for a business.

Source: pinterest.com

Source: pinterest.com

You want to know the present value of that cash flow if your alternative expected rate of return is 3.48% per year. The other cash flows will need to be discounted by the number of years associated with each cash flow. Discounted cash flow is a term used to describe what your future cash flow is worth in today�s value. This is also known as the present value (pv) of a future cash flow. Coupon (2 days ago) our online discounted cash flow calculator helps you calculate the discounted present value (a.k.a.

Source: pinterest.com

Source: pinterest.com

R = the interest rate or discount rate. Discounted cash flow (or dcf) is the actual cash inflow / [1 + i]^n; Starting in year 3 you will receive 5 yearly payments on january 1 for $10,000. Before that, let’s discuss the process of dcf analysis. This calculator uses future earnings to find the fair value of stock shares.

Source: in.pinterest.com

Source: in.pinterest.com

How to calculate discounted cash flow on this website? The discounted cash flow is a quantification method used to evaluate the attractiveness of an investment opportunity.discounted cash flow is a term used to describe what your future cash flow is worth in today�s value. It’s a streamlined spreadsheet model that keeps things fast and simple, and can be used on a variety of platforms. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. What is discounted cash flow valuation?

Source: pinterest.com

Source: pinterest.com

It is the metrics that this financial model uses makes its estimates more accurate. Among the income approaches is the discounted cash flow methodology that calculates the net present value (npv) of future cash flows for a business. Intrinsic value) of future cash flows for a business, stock investment, house purchase, etc. Npv calculator to calculate discounted cash flows. Fcf formula = net cash from/(used in) operating activities minus purchase of fixed assets

Source: pinterest.com

Source: pinterest.com

Here is the dcf formula: Among the income approaches is the discounted cash flow methodology calculating the net present value (�npv�) of future cash flows for an enterprise. This calculator finds the fair value of a stock investment the theoretically correct way, as the present value of future earnings. How to calculate discounted cash flow (dcf) formula & definition. You want to know the present value of that cash flow if your alternative expected rate of return is 3.48% per year.

Source: pinterest.com

Source: pinterest.com

N = the period number. Under this method, the expected future cash flows are projected up to the life of the business or asset in question, and the said cash flows are discounted by a. This calculator finds the fair value of a stock investment the theoretically correct way, as the present value of future earnings. So, the two parts of the calculation (the cash flow and pv factor) are shown above. Discounted cash flow (or dcf) is the actual cash inflow / [1 + i]^n;

Source: pinterest.com

Source: pinterest.com

Home homepage membership levels general discussion complete stock list value investing forum value conference the book podcast membership data coverage founder�s message free trial Analyzing the components of the formula. We discount our cash flow earned in year 1 once, our cash flow earned in year 2 twice, and our cash flow earned in year 3 thrice. Fcf can be calculated from the cash flow statement. This discounted cash flow valuation calculator takes the annual future cash flows from the financial projections template and discounts them back to their value today.

Source: in.pinterest.com

Source: in.pinterest.com

R = the interest rate or discount rate. The other cash flows will need to be discounted by the number of years associated with each cash flow. This is also known as the present value (pv) of a future cash flow. Intrinsic value) of future cash flows for a business, stock investment, house purchase, etc. What is discounted cash flow valuation?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title discounted cash flow calculator online by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.