Your Discounted cash flow formula images are ready. Discounted cash flow formula are a topic that is being searched for and liked by netizens today. You can Find and Download the Discounted cash flow formula files here. Find and Download all free photos.

If you’re searching for discounted cash flow formula pictures information linked to the discounted cash flow formula topic, you have visit the right blog. Our website frequently gives you hints for seeking the maximum quality video and picture content, please kindly search and find more enlightening video articles and graphics that fit your interests.

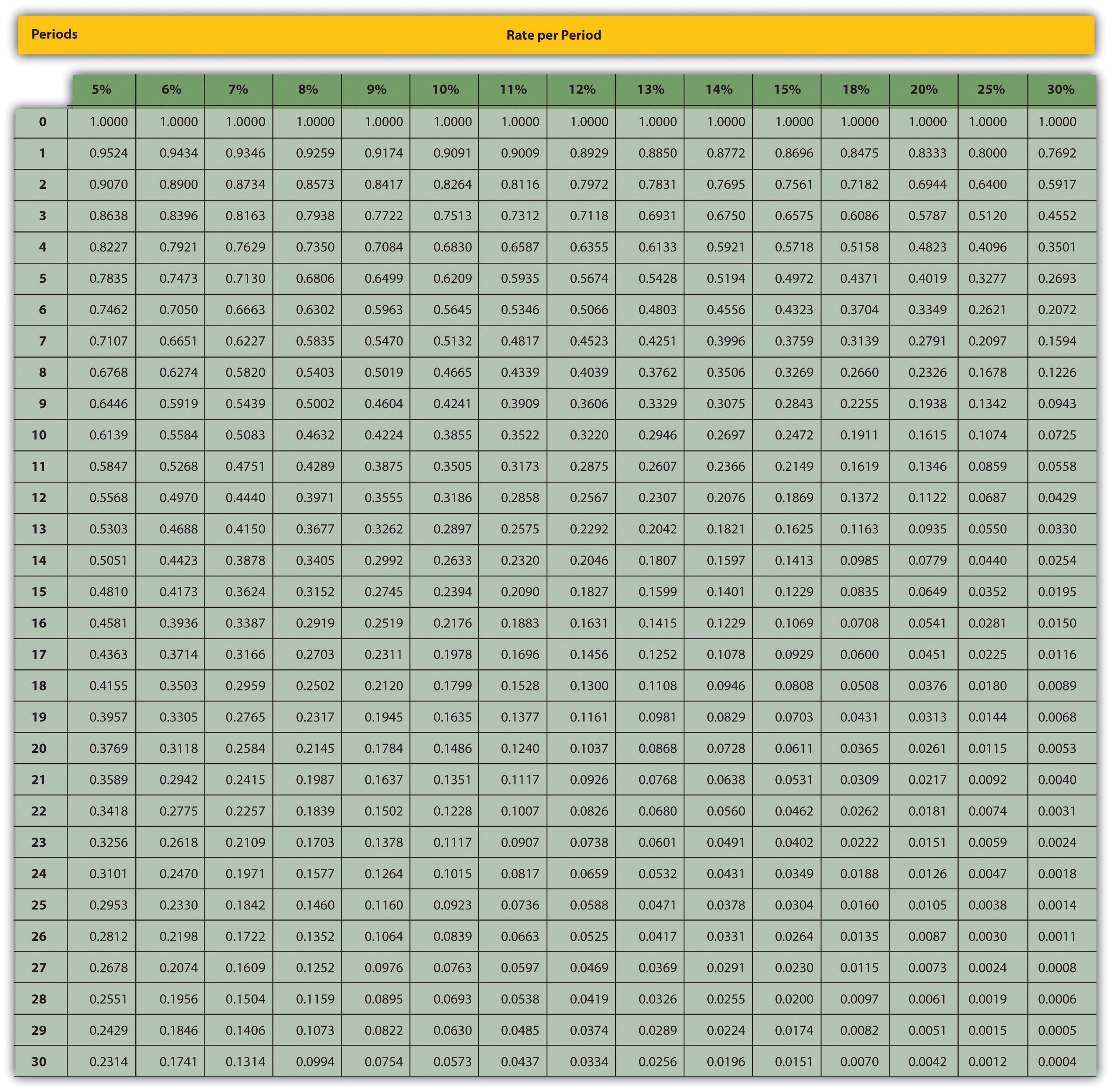

Discounted Cash Flow Formula. Dcf = cft / (1+r)^t. Discounted cash flow for year 1 = 4672.90 If you assume that it is a firm’s cost of capital after taxes is 6%. Cash flow in dcf formula is sometimes denoted as cf1 (cash flow for 1st year), cf2 (cash flow for 2nd year), and so on.

Discount Factor Formula How to Use, Examples and More in From in.pinterest.com

Discount Factor Formula How to Use, Examples and More in From in.pinterest.com

Discounted cash flows are most suitable to use for evaluating investment decisions by comparing the discounted cash inflows and cash outflows. For bonds, the cash flows are principal and dividend payments. Discounted cash flow, earnings quality, measures of value added, and real options [book] It estimates the company’s intrinsic value based on future cash flow. Discounted cash flow = (cash flow period 1 / (1 + interest or discount rate)1) + (cash flow period 2 / (1 + interest or discount rate)2) + … + (cash flow period n / (1 + interest or discount rate)n) abbreviated, it looks like this: Like all the other online ships, cumulative discounted cash flow formula is also offering coupon codes to the customers.

Discounted cash flow is a term used to describe what your future cash flow is worth in today�s value.

The dcf formula the formula for the dcf approach is shown in equation (1) of figure 5.1. The discounted cash flow method is regarded as the most justifiable method to appraise the economic value of an enterprise. The discounted cash flow analysis relies on the information plugged into it, so the end result is dependent on what numbers are used in the formula. Discounted cash flows are most suitable to use for evaluating investment decisions by comparing the discounted cash inflows and cash outflows. 5,000 investment is estimated to be 2,800 per year for 2 years. Discounted cash flow, earnings quality, measures of value added, and real options [book]

Source: in.pinterest.com

Source: in.pinterest.com

If you assume that it is a firm’s cost of capital after taxes is 6%. For bonds, the cash flows are principal and dividend payments. It estimates the company’s intrinsic value based on future cash flow. These terms might be a little unfamiliar, so here’s a quick guide explaining what they mean: Dcf = discounted cash flow.

Source: pinterest.com

Source: pinterest.com

If the investor cannot access the future cash flows, or the project is very complex, dcf will not have much value and alternative models should be employed. (1) the forecast period and (2) the terminal value. The wacc method, the adjusted present value method or the cash to equity method. Includes the inflows and outflows of funds. Note that there are several alternatives of the discounted cash flow method:

Source: br.pinterest.com

Source: br.pinterest.com

Then the discounted current value of one cash flow in one period in the future is shown with the formula: Discounted cash flow = cf1/ (1+r)1 + cf2/ (1+r)2 + cf3/ (1+r)3 + p3/ (1+r)3. Dcf = cft / (1+r)^t. Cf1 is for year 1. If the investor cannot access the future cash flows, or the project is very complex, dcf will not have much value and alternative models should be employed.

Source: pinterest.com

Source: pinterest.com

Discounted cash flow = (cash flow period 1 / (1 + interest or discount rate)1) + (cash flow period 2 / (1 + interest or discount rate)2) + … + (cash flow period n / (1 + interest or discount rate)n) abbreviated, it looks like this: Using the discounted cash flow calculator. Codes (3 days ago) the discounted cash flow dcf formula is the sum of the cash flow in each period divided by one plus the discount rate raised to the power of the period #. Then the discounted current value of one cash flow in one period in the future is shown with the formula: Dcf = discounted cash flow.

Source: pinterest.com

Source: pinterest.com

Note that there are several alternatives of the discounted cash flow method: How to calculate discounted cash flow. If the investor cannot access the future cash flows, or the project is very complex, dcf will not have much value and alternative models should be employed. Cf2 is for year 2. The discounted cash flow analysis relies on the information plugged into it, so the end result is dependent on what numbers are used in the formula.

Source: pinterest.com

Source: pinterest.com

Codes (3 days ago) the discounted cash flow dcf formula is the sum of the cash flow in each period divided by one plus the discount rate raised to the power of the period #. Under this method, the expected future cash flows are projected up to the life of the business or asset in question, and the said cash flows are discounted by a. Includes the inflows and outflows of funds. Codes (3 days ago) the discounted cash flow dcf formula is the sum of the cash flow in each period divided by one plus the discount rate raised to the power of the period #. This is also known as the present value (pv) of a future cash flow.

Source: pinterest.com

Source: pinterest.com

Our online discounted cash flow calculator helps you calculate the discounted present value (a.k.a. Discounted cash flow dcf formula the investor must also determine an appropriate discount rate for the dcf model, which will vary depending on the project or investment under consideration. d c f = c f 1 1 + r 1 + c f 2 1 + r 2 + c f n 1 + r n where: For bonds, the cash flows are principal and dividend payments. Discounted cash flow, earnings quality, measures of value added, and real options [book]

Source: pinterest.com

Source: pinterest.com

The discounted cash flow (dcf) formula is equal to the sum of the cash flow valuation free valuation guides to learn the most important concepts at your own pace. The idea behind the dcf model is that the value of the company is not a function of demand and supply of the stock. Here is the discounted cash flow formula: Note that there are several alternatives of the discounted cash flow method: These articles will teach you business valuation best practices and how to value a company using comparable company analysis,.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title discounted cash flow formula by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.