Your Discounted cash flow formula calculator images are available in this site. Discounted cash flow formula calculator are a topic that is being searched for and liked by netizens today. You can Get the Discounted cash flow formula calculator files here. Find and Download all royalty-free vectors.

If you’re looking for discounted cash flow formula calculator pictures information related to the discounted cash flow formula calculator keyword, you have come to the ideal site. Our website always provides you with suggestions for seeing the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

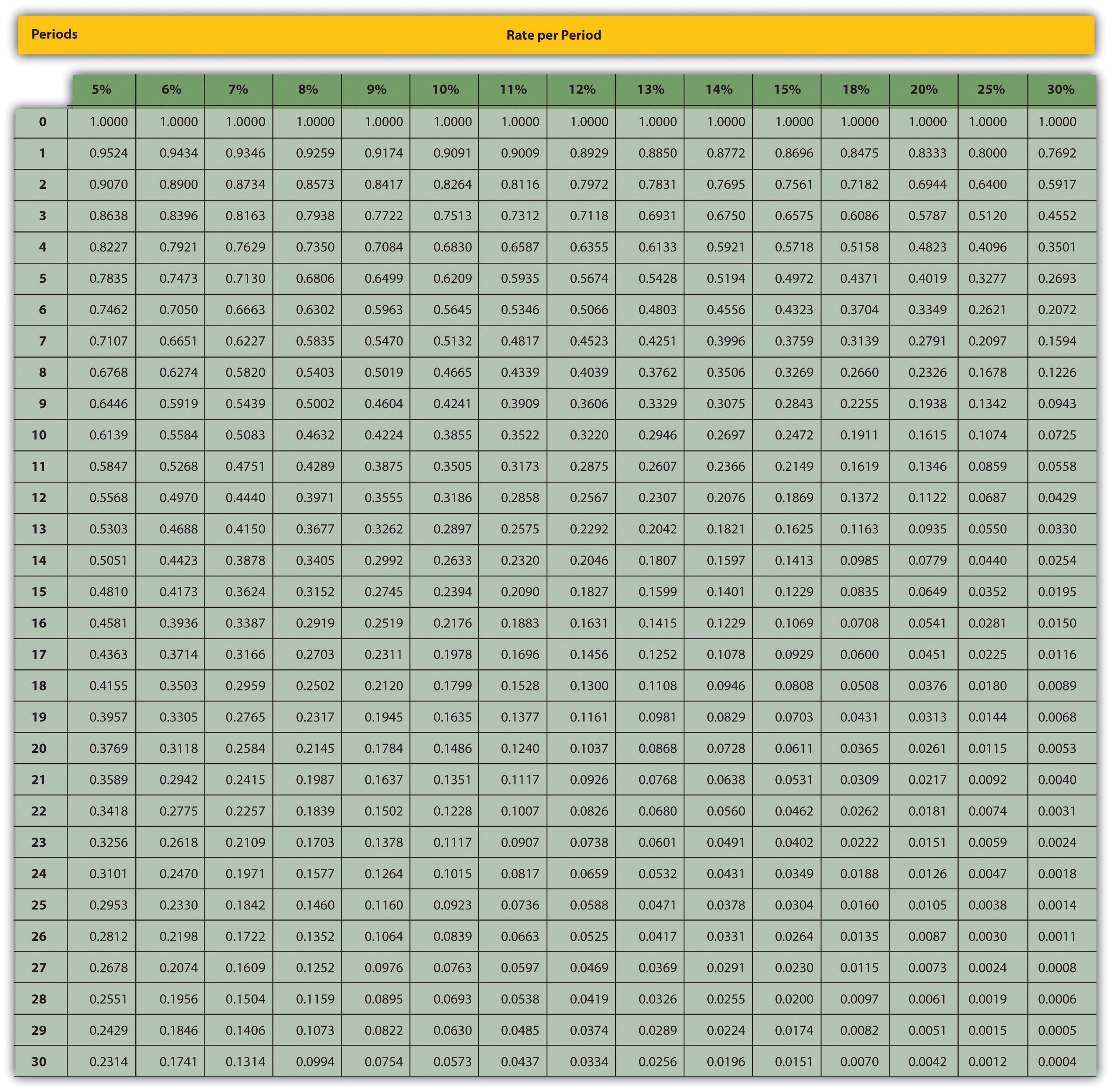

Discounted Cash Flow Formula Calculator. This calculator uses future earnings to find the fair value of stock shares. For example, for year one, it would 5,000 * 0.93458, which will be 4,672.90, and similarly, we can calculate for the rest of the years. Intrinsic value) of future cash flows for a business, stock investment, house purchase, etc. This is also known as the present value (pv) of a future cash flow.

Texas Instruments BA II Plus Financial Calculator in 2020 From in.pinterest.com

Texas Instruments BA II Plus Financial Calculator in 2020 From in.pinterest.com

The discounted cash flow stock valuation calculator is relatively straightforward but allows customization with advanced options. Discounted cash flow is more appropriate when future condition are variable and there are distinct periods of rapid growth and then slow and steady terminal growth. Intrinsic value) of future cash flows for a business, stock investment, house purchase, etc. The current inflation rate in 2018 is about 2%. To discount the cash flow in the nth year, we divide the cash flow in that year by (1+10%)ⁿ, giving us its present value. Discounted cash flow for year 1 = 4672.90

Using the discounted cash flow calculator.

Discounted cash flow estimates the value of a company today based on its future cash flows. Using the discounted cash flow calculator. Discounted cash flow = cf1/ (1+r)1 + cf2/ (1+r)2 + cf3/ (1+r)3 + p3/ (1+r)3. Dcf formula = cf t /( 1 +r) t In finance, the term is used. For example, for year one, it would 5,000 * 0.93458, which will be 4,672.90, and similarly, we can calculate for the rest of the years.

Source: pinterest.com

Source: pinterest.com

It’s also a good idea to keep in mind the inflation rate when choosing a discounted cash flow. Cf = cash flow in the period. Cash flow (cf) cash flow cash flow cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has. Sum up the discounted free cash flows we get from year 1 to year 10, we. Discounted cash flow = cf1/ (1+r)1 + cf2/ (1+r)2 + cf3/ (1+r)3 + p3/ (1+r)3.

Source: pinterest.com

Source: pinterest.com

Using the discounted cash flow calculator. This is also known as the present value (pv) of a future cash flow. For example, for year one, it would 5,000 * 0.93458, which will be 4,672.90, and similarly, we can calculate for the rest of the years. This is also known as the present value (pv) of a future cash flow. Our online discounted cash flow calculator helps you calculate the discounted present value (a.k.a.

Source: pinterest.com

Source: pinterest.com

This calculator finds the fair value of a stock investment the theoretically correct way, as the present value of future earnings. The discounted cash flow stock valuation calculator is relatively straightforward but allows customization with advanced options. Cf = cash flow in the period. This calculator uses future earnings to find the fair value of stock shares. This process continues until all cash flows have been entered.

Source: pinterest.com

Source: pinterest.com

This is also known as the present value (pv) of a future cash flow. C f = the cash flow for the given year For example, for year one, it would 5,000 * 0.93458, which will be 4,672.90, and similarly, we can calculate for the rest of the years. Here is the dcf formula: The discounted cash flow analysis relies on the information plugged into it, so the end result is dependent on what numbers are used in the formula.

Source: pinterest.com

Source: pinterest.com

The discounted cash flow analysis relies on the information plugged into it, so the end result is dependent on what numbers are used in the formula. Cash flow (cf) cash flow cash flow cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has. Analyzing the components of the formula. Discounted cash flow is a term used to describe what your future cash flow is worth in today�s value. Both npv and irr are referred to as discounted cash flow methods because they factor the time value of money into your capital investment project evaluation.

Source: pinterest.com

Source: pinterest.com

How to calculate discounted cash flow (dcf) formula & definition. The income approach, the asset approach and the market (comparable sales) approach. In finance, the term is used. Discounted cash flow is a term used to describe what your future cash flow is worth in today�s value. d c f = c f 1 1 + r 1 + c f 2 1 + r 2 + c f n 1 + r n where:

Source: pinterest.com

Source: pinterest.com

If any of the cash flows occur more than one time in a row (three consecutive periods where the cash flows are all $5,000, for example), then immediately after the cash flow is entered using the key, enter the number of times the cash flow’s value is repeated and press the key. It assumes that the value of a business is equal to the total cash flows accrued over a period of time. Discounted cash flow = cf1/ (1+r)1 + cf2/ (1+r)2 + cf3/ (1+r)3 + p3/ (1+r)3. To discount the cash flow in the nth year, we divide the cash flow in that year by (1+10%)ⁿ, giving us its present value. Using the discounted cash flow calculator.

Source: pinterest.com

Source: pinterest.com

It’s also a good idea to keep in mind the inflation rate when choosing a discounted cash flow. To discount the cash flow in the nth year, we divide the cash flow in that year by (1+10%)ⁿ, giving us its present value. Discounted cash flow is a term used to describe what your future cash flow is worth in today�s value. (1) the forecast period and (2) the terminal value. Dcf formula = cf t /( 1 +r) t

Source: pinterest.com

Source: pinterest.com

Intrinsic value) of future cash flows for a business, stock investment, house purchase, etc. By default, it uses earnings per share to run valuations; Discounted cash flow = cf1/ (1+r)1 + cf2/ (1+r)2 + cf3/ (1+r)3 + p3/ (1+r)3. How to calculate discounted cash flow (dcf) formula & definition. This calculator uses future earnings to find the fair value of stock shares.

Source: pinterest.com

Source: pinterest.com

For example, for year one, it would 5,000 * 0.93458, which will be 4,672.90, and similarly, we can calculate for the rest of the years. Discounted cash flow for year 1 = 4672.90 By default, it uses earnings per share to run valuations; Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Discount cash flow is calculated using the formula given below discounted cash flow = undiscounted cash flow * discount factor dcf for 1st month = 100,000 * 0.96 = 96,194.62

Source: pinterest.com

Source: pinterest.com

Dcf formula = cf t /( 1 +r) t Using the discounted cash flow calculator. The discounted cash flow is a quantification method used to evaluate the attractiveness of an investment opportunity.discounted cash flow is a term used to describe what your future cash flow is worth in today�s value. Discounted cash flow is more appropriate when future condition are variable and there are distinct periods of rapid growth and then slow and steady terminal growth. Among the income approaches is the discounted cash flow methodology that calculates the net present value (npv) of future cash flows for a business.

Source: pinterest.com

Source: pinterest.com

How to calculate discounted cash flow (dcf) formula & definition. Among the income approaches is the discounted cash flow methodology calculating the net present value (�npv�) of future cash flows for an enterprise. (1) the forecast period and (2) the terminal value. How to calculate discounted cash flow for your small business. Using the discounted cash flow calculator.

Source: pinterest.com

Source: pinterest.com

The method helps to evaluate the attractiveness of an investment opportunity based on its projected future cash flows. Dcf formula = cf t /( 1 +r) t 1) what is discounted cash flow ? Expanding the advanced options tab allows you to use free cash flow instead. It’s also important to note that if you miscalculate your projected cash flows or a part of the discounted cash flow formula, you won’t get an accurate result.

Source: pinterest.com

Source: pinterest.com

Cash flow (cf) cash flow cash flow cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has. It’s also a good idea to keep in mind the inflation rate when choosing a discounted cash flow. Discounted cash flow = cf1/ (1+r)1 + cf2/ (1+r)2 + cf3/ (1+r)3 + p3/ (1+r)3. Enter a trailing 12 month earnings per. N = the period number.

Source: pinterest.com

Source: pinterest.com

The discounted cash flow analysis relies on the information plugged into it, so the end result is dependent on what numbers are used in the formula. Discounted cash flow = cf1/ (1+r)1 + cf2/ (1+r)2 + cf3/ (1+r)3 + p3/ (1+r)3. The analysis can be a handy tool to an investor when used right. Enter a trailing 12 month earnings per. To discount the cash flow in the nth year, we divide the cash flow in that year by (1+10%)ⁿ, giving us its present value.

Source: in.pinterest.com

Source: in.pinterest.com

Discounted cash flow = cf1/ (1+r)1 + cf2/ (1+r)2 + cf3/ (1+r)3 + p3/ (1+r)3. By default, it uses earnings per share to run valuations; Analyzing the components of the formula. You can find company earnings via the box below. It’s also a good idea to keep in mind the inflation rate when choosing a discounted cash flow.

Source: pinterest.com

Source: pinterest.com

Using the discounted cash flow calculator. = 2.00/ (1+0.10) 1 + 2.10/ (1+0.10) 2 + 2.20/ (1+0.10) 3 +20.00/ (1+0.10) 3. R = the interest rate or discount rate. Dcf formula = cf t /( 1 +r) t Discounted cash flow estimates the value of a company today based on its future cash flows.

Source: pinterest.com

Source: pinterest.com

Discounted cash flow is more appropriate when future condition are variable and there are distinct periods of rapid growth and then slow and steady terminal growth. Our online discounted cash flow calculator helps you calculate the discounted present value (a.k.a. Cf = cash flow in the period. d c f = c f 1 1 + r 1 + c f 2 1 + r 2 + c f n 1 + r n where: The income approach, the cost approach or the market (comparable sales) approach.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title discounted cash flow formula calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.